The Secure 2.0 Act is raising the catch-up contribution limit for workers, with the goal to make retirement more attainable. Beginning in 2025, participants in 401K or other employer-provided qualified retirement plans who are age 60, 61, 62, or 63 by 12/31/25 can take advantage of the Super Catch-Up Contribution, which is $11,250 instead of $7,500.

Employers should prompt employees to make any desired updates to their 401K contributions before the first payroll in 2025. And employees who fall in this age range should take advantage of this higher catch-up contribution. It is still unclear if this super-catch-up will extend beyond 2025.

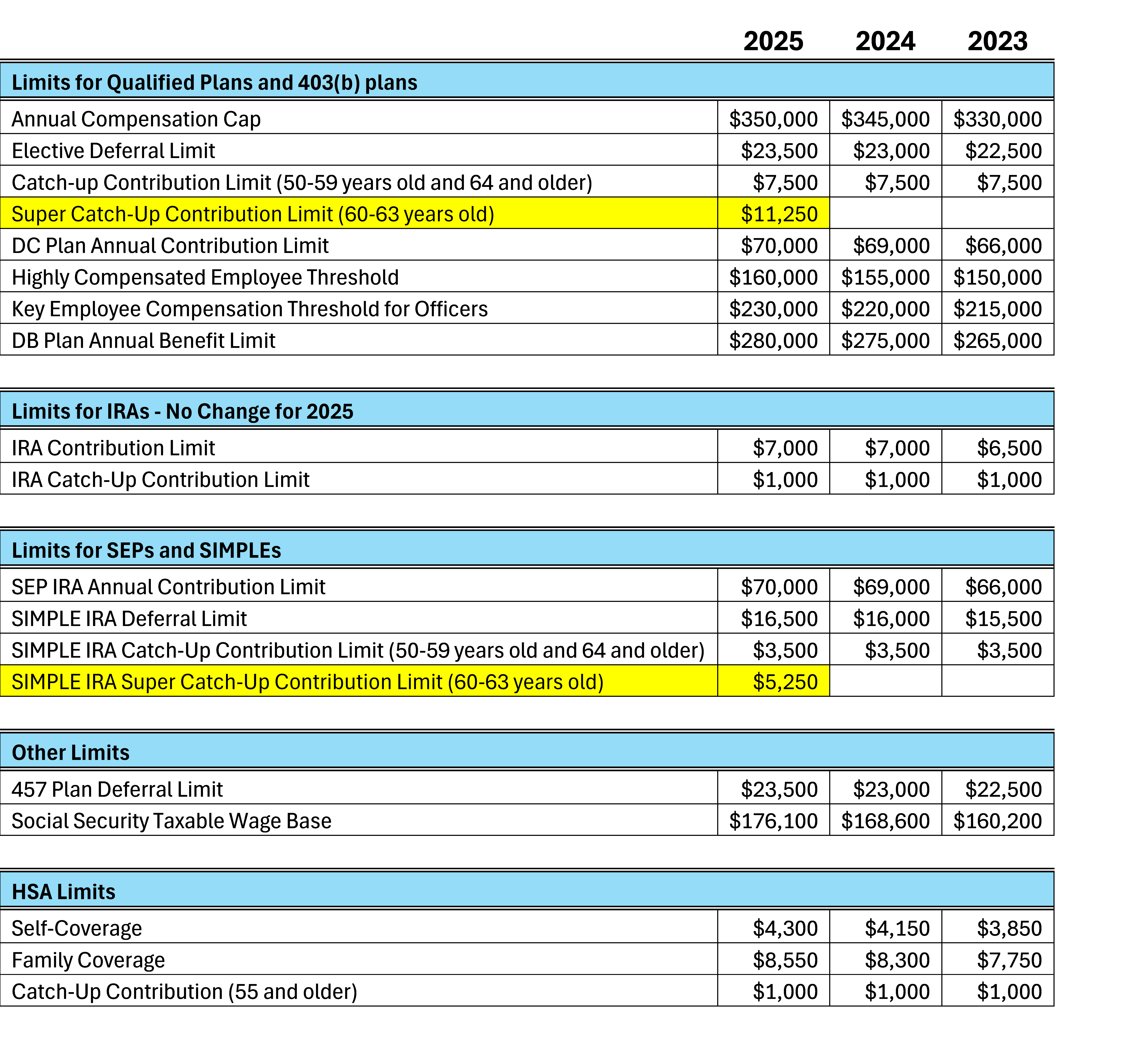

Here are all the 2025 cost-of-living adjustments that will apply to the dollar limits on contributions and benefits under qualified retirement plans, IRAs and Health Savings Accounts.