Let’s talk about how to maximize social security benefits. It is vitally important that you start planning early and know the ins and outs of SSA (Social Security Administration) to ensure a comfortable retirement with maximum payments. Timing is everything, and life seems to be more expensive every day.

Taking Social Security benefits too early or too late can reduce the total amount of your Social Security income. However, finding the perfect age and just-right scheduling depends on your circumstances, income, spouse’s Social Security, and other SSA rules and regulations that require your attention and knowledge.

Furthermore, SSA laws have changed over the years, so staying current is another strategy for maximizing your benefits.

Age and Work Credits

You can apply for Social Security benefits starting at age 62, but you are only entitled to full benefits once you hit your Full Retirement Age (FRA), as explained at this SSA.gov site. The FRA is dependent on the year you were born. However, you must accumulate a minimum number of work credits before you can apply, which will be covered below.

Age

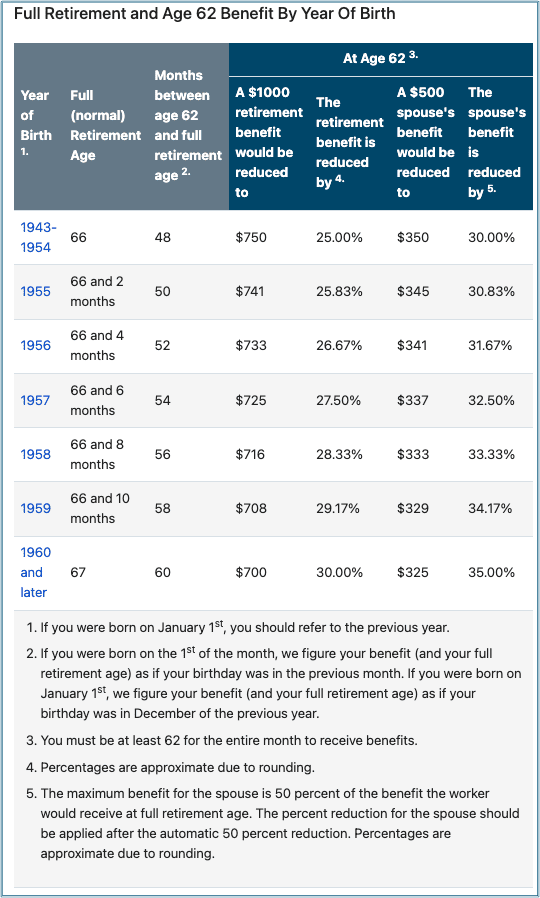

Here’s why the starting age is important: If you begin taking payments at age 62, you will get less than what you would get if you waited until your FRA at 70. To see how much your benefit will be lessened by receiving payments before your full retirement age, click here. Please pause now and look at the table from the SSA carefully.

Pay attention to the level of detail and the footnotes! Each two months can make a difference in your benefit. You must be 62 for an entire month to receive the benefits. If your birthday is on the 1st of the month, the retirement is based on the previous month or the previous year if your birthday is January 1st. The rest of the page has more recommendations regarding your decisions, which will, in turn, help you ask better questions of your CPA or an advisor about your retirement.

Work Credits

From this SSA blog: “Retired workers need 40 work credits to be eligible for benefits, but your work credits alone do not determine how much you will receive each month. When we figure your retirement benefit, we use the average of your highest 35 years of earnings. See Your Retirement Benefit: How It Is Figured for more information.

“The amount of earnings it takes to earn a credit may change each year. In 2024, you earn 1 Social Security and Medicare credit for every $1,730 in covered earnings each year. You must earn $6,920 to get the maximum 4 credits for the year. During your lifetime, you might earn more credits than the minimum number you need to be eligible for benefits. These extra credits do not increase your benefit amount.” Source: SSA

Each step toward learning more about your Social Security benefits builds upon itself. People of any age can see their future benefits by simply opening an account with the SSA—the younger the better!

Your Circumstances

Even if you would like to wait until age 70 to receive the highest possible benefit, your or your family’s circumstances may prevent that. Each year you wait after age 62, your benefit increases by 8%, but you may need the money now for a family emergency or to pay the monthly bills. Social Security has so many different aspects that it pays to make sure you’re making the best decisions, as we are living longer than ever.

Examples

For a detailed set of examples, please review the SSA.gov Examplemax website starting with retirement in 1987 and examples for retirement at ages 62, 65, 66, 67, and 70. They show monthly benefits for someone who started working at age 22 and continued working to retirement in 2024. The figures at the bottom right of the table, show that a person retiring at age 70 with an Average Indexed Monthly Earnings (AIME) of $9,990 would receive $4,873 per month. That’s the most for 2024. The table also shows numbers that are worth taking time to review.

Note: The monthly benefit is less for each year younger than 70 at retirement.

And if you miss taking your benefits after age 70, you cannot “go back” and get them. Once you hit 70, the 8% increase between age 62 and 70 (as noted above) stops being added to the final check payments. It’s up to each of us to apply to the SSA for our benefits.

Remember: Social Security Administration payments are not automatic.

Your Income, Your Spouse’s Benefits, and More

The Social Security Administration has an entire webpage on spouses, children, and survivors. One of the most asked questions is answered on the website:

FAQ: “Can I collect Social Security spouse’s benefits and my own retirement benefits?”

SSA Answer: “Yes. If you qualify for your own retirement and spouse’s benefits, we will always pay your own benefits first. If your benefit amount as a spouse is higher than your own retirement benefit, you will get a combination of the two benefits that equals the higher amount.”

There are many more questions to be asked and answered. Whose benefits or, perhaps, whose wages are higher? When are you or your spouse going to retire? Are there any health issues?

What should you do before you begin to take benefits?

We recommend this Social Security Spouse’s Benefit Estimate website. It has a worksheet to help you and your spouse decide. Making the correct choice at the right time can mean a difference of thousands of dollars in retirement income.

The other situation occurs when one of the spouses dies, and there is more than one previous spouse. The widow(s) or widower(s) would be entitled to a survivor benefit if they were married for ten years or more. Children under 16 years old can also receive benefits. These are tricky waters to navigate, and the best course is to have experts in Social Security help in these decisions and other aspects of Social Security.

Conclusion

With life expectancies rising and inflation challenging the edges of cost-of-living increases that Social Security is supposed to handle for us, maximizing one’s Social Security benefits as much as possible is wise. It is best to start planning early, use the many government-provided websites on the topic, and work with professionals who specialize in retirement planning and are familiar with the current Social Security rules and regulations. The government has a plethora of information about your retirement. Start with this website.

Here’s another good reason to maximize your Social Security payments: You will be taxed on your Social Security income, and you will automatically be enrolled in Medicare Part A (hospital insurance) at age 65 if you are receiving Social Security benefits. If you paid into Medicare through your taxes for ten years or more, there will be no deduction for Part A. If you paid in for less than ten years (40 quarters), you will pay $505 per month in 2024 for the Medicare Part A premium. Taxes and Medicare payments (Part A and Part B and D if you choose the latter two) will reduce your monthly “take home.” Some people don’t factor in taxes and Medicare in their retirement budget.

Feel free to contact us at LSL CPAs for guidance and recommendations on maximizing your Social Security benefits to enjoy your retirement years to the fullest.