Misconceptions, Facts, Definitions, and TIPS

We’re learning that some companies’ owners and managers are unaware of their tax liabilities in states other than where they’re physically located. Plus, a fair number of organizations think only about federal and state income tax for their satellite offices, which is incorrect and short-sighted.

Misconceptions

One of the misconceptions regarding multi-state taxes starts with believing that the state income tax applies only to the state where the company is physically situated. So, if you are thinking of moving out of state or opening additional offices outside of your base of operations, many tax ramifications rear their heads.

Not knowing the law is no excuse. We believe that as business owners seek growth, they are excited, of course, and are not purposefully evading taxes. They just don’t know what they don’t know. However, the penalties for not paying taxes, whatever the reason, can be stiff. Though unlikely, it is possible that a state could ban a company from doing business in their state along with imposing fines and interest for back taxes owed.

Facts

Taxes are a Fact of Life—no matter where you are. There’s no escaping them. Taxes are as predictable and unavoidable as the seasons. And keeping track of your tax liabilities across multiple states is becoming more critical every day. It’s exciting to do business in many U.S. regions, but different tax laws may apply. It bears repeating:

There are more than federal and state taxes to consider!

Businesses of all sizes must comply with (file and/or pay) the state taxes for all four of these categories for every state in which they do business if they “qualify” through what is called “nexus.” (More on that below.)

Definitions

Here are the taxes for which you may be liable.

- Income tax

- Sales tax (state and local)

- Use tax

- Payroll tax

Income Tax

Based on your tax returns, these taxes are levied on the income you declare in the jurisdiction in question.

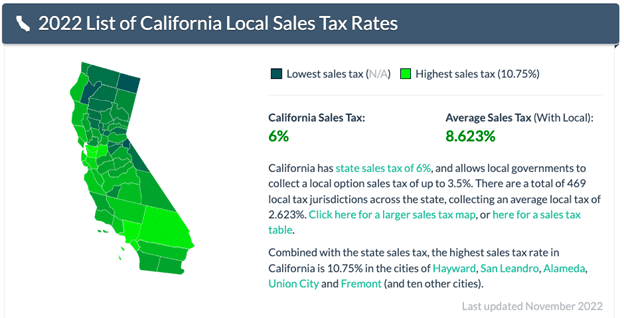

State and Local Sales Tax

Don’t forget local sales tax reporting and collection for the sales you make. Here’s an overview of California’s local sales tax rates from this website:

California Sales Tax Handbook. Every state has its own rules and regulations.

Use Tax

“The term use tax refers to a conditional sales tax. The use tax is charged on any goods purchased without paying a sales tax when one would normally be applied in their home state. One of the most common instances of the use tax is when someone buys goods from another state where no sales tax is levied and the consumer intends to use, store, or distribute the goods where a sales tax would normally apply.” Source: Investopedia. Ask your CPA and tax attorney for more on this.

Payroll Tax

Payroll tax varies across the 50 states and has become especially important considering the number of remote workers we have post-pandemic. Your HR department should be on top of these rules. See our post on remote workers.

Before you throw up your hands, we have some suggestions.

TIPS for Companies Doing Business in More than One State

- Ask your CFO if they have a handle on multi-state tax issues. To start, ask them respectfully if they know what the term “nexus” means relating to tax issues. The word “nexus” by itself means “connection.” As it relates to tax issues, the word nexus means that the company has some kind of connection with the state, and every state has different levels of “connectedness” in terms of sales, employees, and personal property for its “nexus.”

For starters, the threshold amounts for nexus in several categories vary by state. In California, according to the State Franchise Tax Board, California defines that you are doing business and are subject to its tax laws as follows.

From the Franchise Tax Board Website “Doing Business in California”:

“We (the state of California) consider you to be “doing business” in California if you meet any of the following:

- Engage in any transaction for the purpose of financial gain within California

- Are organized or commercially domiciled in California

- Your California sales, property or payroll exceed the following amounts:

For the tax year 2021, threshold amounts were as follows:”

| California sales, property, or payroll | |||

| CA sales exceed (either the threshold amount or 25% of total sales) | CA real and tangible personal property exceed (either the threshold amount or 25% of total property) | CA payroll compensation exceeds (either the threshold amount or 25% of total payroll) | |

| $637,252 | $63,726 | $63,726 | |

NOTE: The rest of this chart—showing values for 2020 to 2014—can be found on this page.

- Don’t forget that every state and local government is empowered to levy taxes. If you move your business out of state during a tax year, check with that state’s tax laws. And the state you’ve moved from. It isn’t very easy! Fifty states times three kinds of taxes? That’s 150 tax laws that your company could potentially need to know. Some companies have CFOs that feel comfortable with the idea of multi-state taxation. However, knowing about it and following the letter of the law are two different things.

- Don’t panic. Make it your responsibility to research applicable multi-state laws. It’s okay for now not to know, but it’s not okay to stay that way. Understand that people who know about nexus and about multi-state tax laws don’t necessarily know the details. There are classes and webinars on multi-state tax laws. Some CFOs are whizzes at it, many attorneys have become specialists, and good CPAs are working with both and will work with you. Be aware that you can get help from all three.

CONCLUSION:

Taxes have become ever more complicated as multi-state commerce has blossomed. If you’re moving your business out of state, or if you are moving but your business remains in California, be sure you understand each state’s income tax laws, but also the state and local sales tax issues. Use tax and payroll taxes cannot be overlooked either.

The fines for late payments or non-payment of taxes in any state can be expensive, and the state can bar you from doing business there. Take charge of your multi-state tax knowledge!

Remember, you’re not alone. Check with your CFO, your tax attorney and of course, your CPA for advice and counsel.

If you’re considering moving out of state and want to know how it will impact your tax situation, contact your LSL advisor. It’s a great place to start. And now is a good time.