Divorce reshapes nearly every corner of your life—your home, your finances, your future. In the middle of all the legal decisions, parenting changes, and life adjustments, taxes might be the last thing on your mind. However, it needs to move up on the list, and getting your CPA involved early in the divorce process can make a big difference.

5 Tax Tips for Divorcing Couples

When navigating a divorce in California, taxes may not be the first thing on your mind—but they can have a lasting impact on your financial future. From how assets are divided to who can claim certain deductions, tax considerations play a key role in the overall process. This guide outlines the key tax issues to be aware of as you move forward.

1. Timing and Filing Status

In California, your filing status for the year depends on your marital status as of December 31.

- If your divorce is final by December 31, you will file as single or head of household (if you meet the requirements for claiming a qualifying child).

- If your divorce is not final by December 31, then you will have to file Married Filing Jointly (MFJ) or Married Filing Separately (MFS).

Note: For the pros and cons of Married Filing Jointly vs. Married Filing Separately, asking a CPA is the best bet, because each case is different. Seeking guidance will benefit both parties.

Insider’s Tip: When changing filing statuses, be sure to revisit W-2 withholdings and estimated tax payments, as tax brackets vary depending on filing status.

2. Property Division: Community Property vs. Separate Income

Community vs. Separate Income —Under California law, all income earned during the marriage is considered to be “community property.” This means that if you have to file Married Filing Separately (MFS), all income is split 50/50, unless otherwise agreed. This decision becomes a significant factor if the divorce isn’t finalized and you have to file MFS. Also, being in a community property state like California, be prepared to provide documentation for assets such as premarital investments, properties, and inheritances if you want to protect them from division. Having a CPA involved from the outset is a great idea.

Note: This decision becomes most important if you’re planning a “Married Filing Separately” tax return.

Insider’s Tip: Documentation is important, especially when homes are purchased with comingled funds and retirement accounts include pre-marriage contributions. (See Asset Transfers and Retirement Accounts, below.)

3. Asset Transfers and Capital Gains Exposure on Real Estate or Investment Accounts.

Property Divisions/Transfers—If properties/assets are transferred between spouses as part of a divorce agreement, then the recipient doesn’t have to report that as taxable income. However, for capital gains purposes, for things like stocks or real estate, the recipient spouse does take the original basis of those assets, which can come into play when the spouse sells the asset. For example, if a house was bought for $300,000 and transferred to a spouse, the spouse’s basis in that house is $300,000. If the spouse later sells it for $500,000, then the capital gain would be $200,000 before considering exclusions, which can be complicated and may need CPA interpretation and guidance.

Insider’s Tip: Accurate Capital Gains tax calculations rely on good recordkeeping.

4. Retirement Accounts and Innocent Spouse Relief

It’s important to divide retirement accounts correctly and seek Innocent Spouse Relief if needed to avoid tax penalties—but it can be tricky.

- Retirement Accounts—A QDRO (Qualified Domestic Relations Order) is a court order used in divorce to divide certain retirement plan benefits without triggering taxes or early withdrawal penalties. This only applies to qualified plans, such as 401(k) plans, 403(b) plans, and defined benefit pensions, and does not apply to IRAs. IRAs are divided under different rules and can be distributed upon receipt of a divorce decree or written settlement.

- Innocent Spouse Relief—Innocent Spouse Relief is an IRS provision that allows a spouse or ex-spouse to be relieved from tax liability caused by outright fraud or unintended errors committed by the other spouse on a joint tax return. Relief would be provided if the spouse did not know and had no reason to know about the error. Full or partial relief could be granted; for partial relief, the couple could request to split the tax liability based on each spouse’s portion of the tax. File IRS Form 8857 to request this relief.

Insider’s Tip: The QDRO must be approved by the retirement plan administrator and meet specific criteria set by ERISA and the plan itself. For more information about California’s QDRO, see this website.

5. Alimony, Child Support, and Dependency Claims: Allocate and Document

Allocating cold, hard cash among these heart-rending, deeply personal family concerns takes special attention. These particularly delicate issues are sometimes put off to the end of long days and months of negotiations and piles of paperwork. Everyone is exhausted.

CPAs don’t like it either, because it’s so hard, but they are experienced in it and can help couples through the financial and personal aspects of marriage dissolution.

- Alimony (Spousal Support)—Federal and California laws differ here. Alimony for divorces finalized after December 31, 2018, is not deductible on the payor’s federal return, and likewise isn’t considered income on the payee’s federal return.

Note: California does not conform to this federal treatment; therefore, alimony paid after December 31, 2018, is deductible for the payee and is reported as income to the payor.

- Child Support— Child support is not deductible by the payor, and it’s not taxable income for the recipient. California’s child support guidelines conform with the uniform child support guidelines established by the federal government. Check this website for child support calculators. From that website:

“The child support “guideline” on which the calculators are based is not an optional guide but is the name for the state law setting out a standardized formula for calculating child support.”

- Dependents—Only one parent can claim a child as a dependent, and by default, the parent who has custodial claim of the child can claim the child as a dependent. If the custodial parent wants to allow the other parent to claim the dependent, then IRS Form 8332 (Release/Revocation of Release of Claim to Exemption for Child by Custodial Parent) should be prepared. The custodial parent would sign the form, which would then be included with the non-custodial parent’s tax return.

Insider’s Tip: Regarding deductions—Most divorce-related legal fees are not deductible. The only exception is that fees specifically for tax advice or securing taxable alimony may be deductible.

CONCLUSION

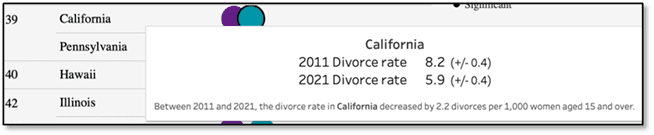

HERE’S A SURPRISE: California’s fabled high divorce rate is NOT 60%.

While many sources still reprise the high 60% divorce rate for California, the U.S. Census Bureau based on data from the American Community Survey (ACS) indicates that California is 39th in divorce rate (tied with Pennsylvania) out of the 50 states and the rate dropped from 8.2% in 2011 to 5.9% in 2021.

Unfortunately, statistics don’t help the divorcing couple.

The bottom line is that the federal and state tax laws for divorces are set in, and they’re complicated. Dealing with the financial fallout of a divorce and its tax consequences is best handled by a concerned yet arms-length expert, such as a CPA experienced with divorce tax matters.

Please get in touch with LSL CPAs for divorce tax guidance (and just plain tax guidance!).