We hope you’re aware that the “full-scope audit” for the 401(k) plan requirement for more than 100 employee participants is now called an ERISA 103(a)(3)(C) audit.

Does the 80/120 Rule still apply? YES.

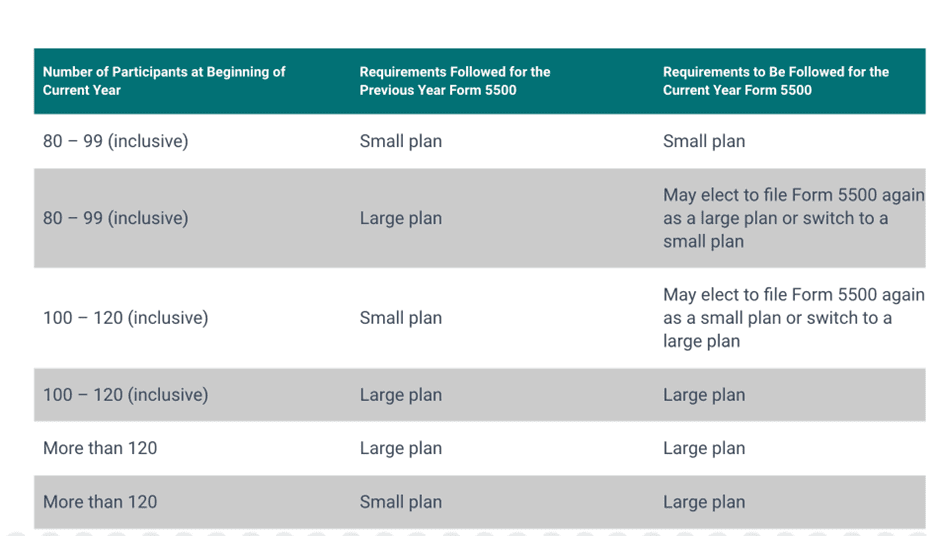

As we know, the 80/120 rule states that your participant count can climb up to 120 before an audit is required. This rule is designed to help small-to-medium-sized companies avoid the audit requirement so they can focus on growing their businesses. We posted on this topic earlier, which applies to 401(k) and retirement plans for companies where the participant count is above 80 and up to 120 participants.

Large and Small Benefit Plans

The reporting for employee benefit plans is done via the IRS’s Form 5500. It should be filed at the end of each fiscal year by your plan administrator. Two versions of the form exist. 1) The long version (standard) Form 5500 for large benefit plans, and; 2) The short version for small benefit plans with fewer than 100 eligible participants at the beginning of the plan year. The number of plan participants includes eligible (but not currently participating, such as deceased) employees, active participants, and separated or retired employees who now receive benefits under the plan.

What is the 80/120 Rule, again?

The 80/120 rule provides an exception for newer businesses on the rise. Here are the guidelines: If you (a) have between 80 and 120 plan participants, and (b) were deemed a small plan in the preceding year, you can go on filing the shortened version of Form 5500. With over 120 participants, you must file as a large plan. Also, once you file as a large plan, you must continue to file as a large plan— even if your participant count drops below 120, and as long as you have at least 100 participants in your plan.

External audits are good “insurance”

The 401(k) and 403(b) plans filed as “large” plans (on Form 5500) must be audited by an independent accounting firm. Audits such as these ensure you are running your employee retirement plan in accordance with the Department of Labor (DOL) and IRS requirements. At the same time, as the plan owners, you will always have fiduciary responsibility over your plan regardless of size. So, an external audit, even for smaller plans provides extra “insurance” that you are acting on behalf of the plan members.

Boy Scout Motto: Be Prepared

If your company’s plan is approaching the 120-member point, it’s a great time to become familiar with your plan’s audit process. The retirement plan audit will be in addition to an annual financial statement audit. The plan auditor will look at only your plan’s activities and any related documents. To prepare for your first 401(k) audit, we recommend you do the following:

- Make sure you are compliant with your plan’s documents, the IRS, and DOL rules.

Be familiar with your plan document and its clauses. Know IRS and DOL regulations. Follow the reporting requirements and attend to distributions so your auditor can issue a squeaky-clean opinion.

- On audit day, have everything ready

Pull your current year’s list of eligible participants, plan documents and amendments, and discriminatory tests and findings, etc.

- Don’t wait until “Audit Day” if you have questions!

Part of being prepared is seeking advice ahead of time. Counterintuitively, last-minute audits often take more… not to mention extra stress on both teams.

What should you expect to pay for an audit?

That depends on the complexity of your plan, which in turn depends on

- If this is your first year for an audit

- Whether you need a limited or full-scope audit

- Whether you are changing 401(k) providers, and

- If your company has experienced a lot of turnover during the plan year. In that case your list of participants will have to be scrutinized.

Bottom line?

Talk with your plan’s third party administrator (TPA) and financial advisor to help make sure your retirement plan is properly managed. Part of that managing your plan is remembering how important it is to have a clean audit in line with IRS and DOL regulations. Fines and penalties are not good for any sized business. And, talk with LSL if when your plan meets the requirement for audit.