It’s not just about collecting money that is owed to you, but receiving it in a timely manner. Making a small adjustment can lead to a BIG increase in your cash flow.

After we’ve shown you how much collecting quickly can increase cash in five days (almost 400% in our example), we will give you some ideas on how to do it.

- Three top-level ideas to get paid ASAP.

- Drilling down and leveraging technology.

- Accounts receivable software—where to start?

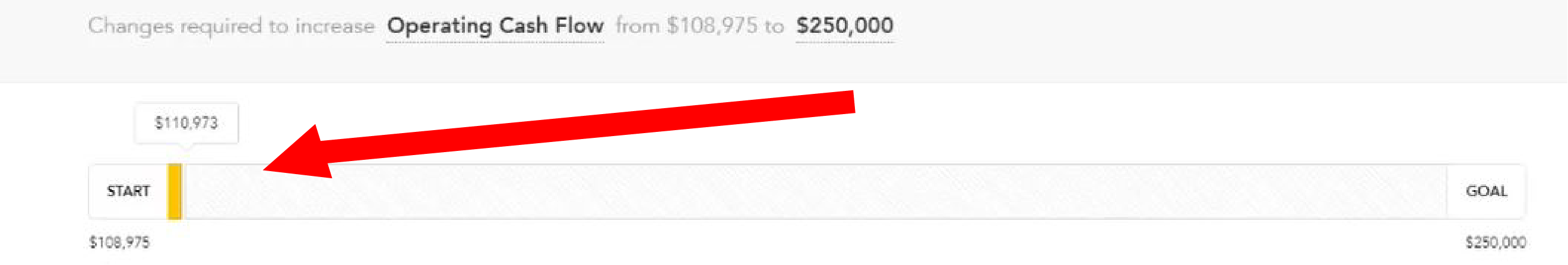

Let’s look at how improving your receivables (collection) strategies can affect your cash flow. Reducing receivables outstanding by just FIVE days—in this client’s case, from 72 days down to 67 days—the amount of cash on hand goes from about $109,000 (as shown here)

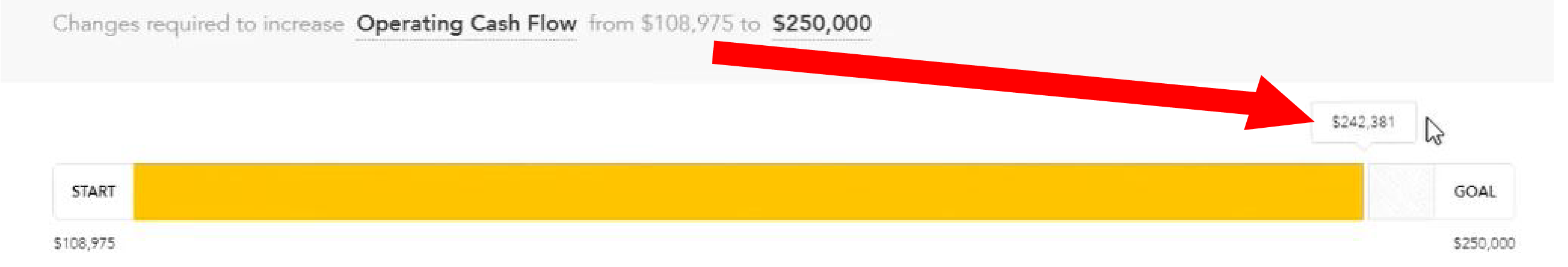

… up to $394,000 (!) as shown below.

Going from $109.000 to $394,000 in five days resulted in over a 300% (almost 400%) jump in cash on hand. Here are some ideas on how to do that in your business.

Three top-level ideas to get payments ASAP

- Hire a separate AR clerk to “encourage” customers to pay their bills promptly.

- Use monetary incentives (discounts) for paying by the 10th of the month.

- Add out-of-the-ordinary inducements to get paid early. In days gone by, companies would partner with travel companies and give “travel points” redeemable for hotel stays and air travel for paying by the 10th. Get creative here.

Drilling down and leveraging technology

- Automate your invoicing process with technology to save time and speed up payments.

- Make it easy and convenient for your customers to pay. QuickBooks offers several options inside their invoicing tool. ACH, debit cards, and credit cards, etc. are easily accessed for one-click payments for your customer’s convenience.

- Research other 3rd-party apps that will speed up the money coming to you. As you consider leveraging technology for A/R, we offer the following:

Accounts Receivable Software—Where to start?

Accounts receivable software options are plentiful these days. Their benefits are in how they streamline things, such as:

- Invoicing your clients and customers.

- Collecting payments without hiring a person.

- Tracking outstanding payments with the software (untouched by human hands).

- Recording received payments in your general ledger with proper setup.

- Using the data to run reports and analyze your company’s financial position.

You’ll want to do your homework, though.

- What amount of automation do you need?

- How much does it cost?

- How well does the system integrate with your existing accounting software?

- Does your team (really) know how to use the features? AND

- Do they realize how the software benefits the company? OR

- Will they be wondering if the software will replace them?

- Will staff need training and reassurance?

Good cash flow management separates success from failure on the dramatic downside. But on the exciting upside, healthy cash flow can stimulate growth and fund expansion.

Contact your LSL advisor for advice and recommendations for your company. We love to talk to our clients about how they can make more money.