It’s always good to be reminded of sound business principles. This is one of those.

You SHOULD NOT pay your bills too early!

We know. Your mom and dad taught you to pay your bills on time to have a good credit rating. That’s still good advice, but when you’re running a business, while you DO want to pay your bills on time to keep your vendors happy, paying them early is not good business.

Questions we will answer here.

- What business philosophy supports waiting to pay bills?

- What is “too early”?

- What is an example of how changing number of days to pay relates to cash flow?

1. What business philosophy supports waiting to pay bills?

“CASH IS KING!”

a. In “How to Increase and Project Cash Flow” (my March 4, 2021 post), the essence of maximizing cash stems indirectly from the Boy Scout Motto, “Be Prepared.” By having money on hand, you are prepared to handle out-of-the-ordinary events, last minute changes in lead times, perhaps, and/or accidents and the unpredictable—floods, fires, pandemics—without breaking a sweat.

b. Maybe business slows down without a catastrophe. You’re prepared for that too.

c. Opportunity knocks. Say your biggest competitor needs to make a quick sale. If you have cash, you’re on it like white on rice.

By waiting to pay your bills just before they are due, you can leverage your flexibility to handle the unforeseen, and have funds to open the door when opportunity rattles your door knob.

By the way, for a definition of “cash,” please refer to this blog post.

2. What is “too early?”

Paying too early is paying before the bill is due. If the bill is due on January 15, pay the bill so it arrives on a business day before January 15. Do not pay it before then unless:

a. There is a discount offered for paying early (e.g., the terms might be 2% 10, net thirty, meaning you will get a 2% discount on your bill if you pay it before the tenth of the month, and the full amount is due at the end of the thirty days – see below.) OR

b. There is a better use for the 2% discount to achieve another goal, maybe investing in inventory or equipment that yields a better “return” on that money than 2%. OR

c. The early payment falls into the tax year in which you need more expenses to offset income, for instance. OR

d. Another (more attractive) incentive has been offered by the vendor for paying early.

The general rule is to pay as close to the last possible day without incurring a penalty (or a bad name with your vendor). However, the “rule” of not paying early needs to be evaluated against other parameters as mentioned above.

3. What is an example of how changing number of days to pay relates to cash flow?

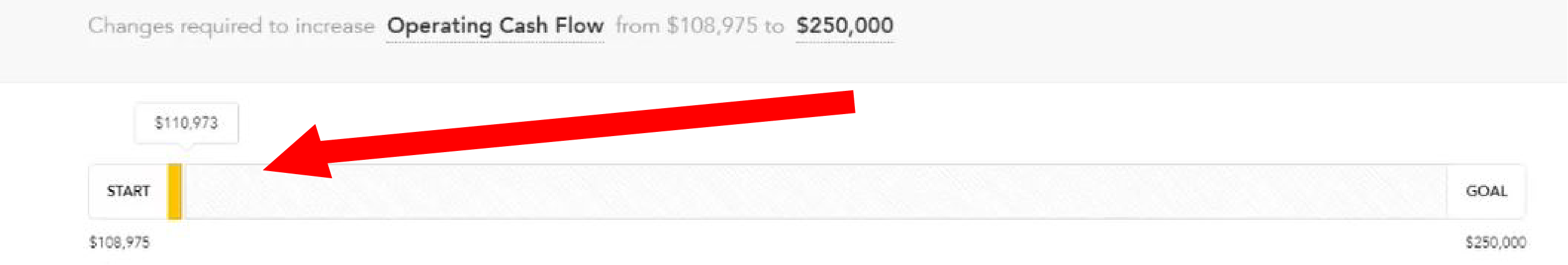

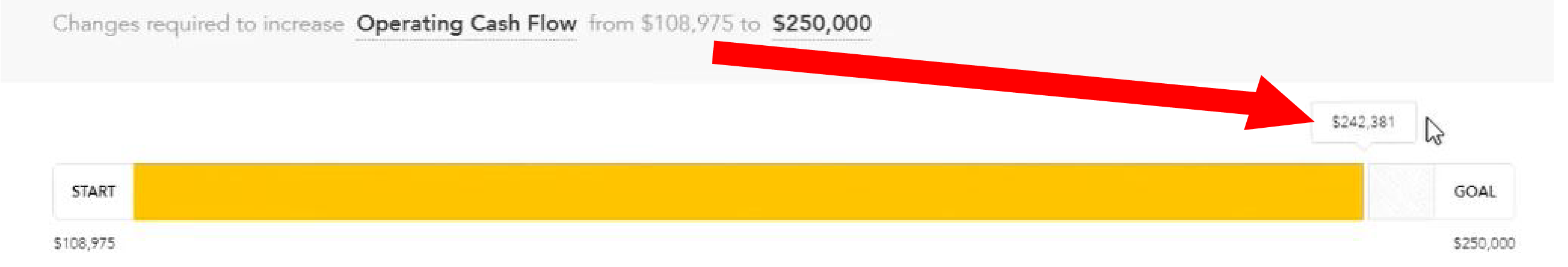

If Company A has almost $109,000 in cash and pays their bills immediately, they use up all their cash! Waiting even FIVE days to pay bills increases cash to $242,381!! The calculation in QuickBooks can be seen here.

Paying in 1 day:

Waiting just FIVE DAYS to pay

This company has increased cash markedly in one month by delaying paying bills by only five days. Delaying more days would increase the cash on hand.

The idea of maximizing your cash not only lets you be prepared, it also helps in making decisions in the short- and long-term future by engaging in cash flow projections available to you for investing, growing, acquisition, merger, etc. For ideas on cash projection, please refer to my March 2021 blog post.

Proper handling of cash can make your business even more successful. Please contact your CPA at LSL if you have questions!