Recently, one of our clients wanted to know the rules for hiring their children in their business and using those funds to contribute to a retirement account. In the old days, allowances were used to teach our kiddos how to handle money. But as they grow up, it’s possible to teach them how to manage money and be a part of the “working world,” while helping them to retire rich.

Employing your kids can provide you with a business deduction for the wages you pay them, if handled correctly. Moreover, you might discover that your children would like to take over the business one day. Or not—which is also important to know for managing everyone’s expectations.

Employing family members must be done legally, meaning it is not recommended for your four-year-old. The IRS has rules, which you can view some basic information here, and/or you can scan our summary below.

Rules for Hiring Your Kids

- Reasonable and Necessary: To take a business deduction for wages paid to your child, you must assign them work that is necessary for the business, and the wages must be reasonable. So, you can’t pay them $6,000 a year to work one eight-hour day “at the office” doing filing. Again, it’s hard to justify wages paid to younger children (under 10 for instance).

- Employment Taxes: Currently, the 2023 Publication 15, Circular E, Employer’s Tax Guide (Section 3, Family Employees) states if your company is

- A corporation, you would have to pay social security and Medicare, and FUTA tax on the wages paid to them.

- A sole proprietorship/partnership, “…Payments for the services of a child under age 18 who works for their parent in a trade or business are not subject to social security and Medicare taxes if the trade or business is a sole proprietorship or a partnership in which each partner is a parent of the child.”

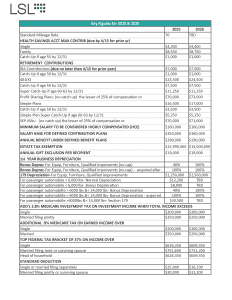

- Federal and State Withholdings: They would be required to withhold federal and state taxes on the money earned. Even though they wouldn’t pay tax on income up to $12,550, they would still be required to withhold taxes on that income and file a tax return to get the withholdings refunded. Please refer to IRS Publication 929 for details.

- Formality: You would need to pay them formally, on a routine basis, with other employees, and they would need to receive a W-2 at the end of the year. Of course, they need a social security number, and “adulting” will occur when they fill out their first Form W-4, Employee’s Withholding Certificate (the 2023 version is here).

Great Way to Help Your Kids Retire Rich

For 2023, a minor child can contribute up to $6,500 to a ROTH IRA. In order to pay your child $6,500 in wages (at the California Minimum wage rate of $15.50), you would be having them work 420 hours over the year. That’s about eight hours a week. You would also probably want to pay them a little more to cover their portion of social security and Medicare tax that would be withheld so that the “net” cash received would be $6,500.

Here’s the best part. Because of the joys of compounding (another cool adulting term), your 10-year-old could amass $3,732,017.28 if they kept up the $6,500 (ROTH IRA) savings every year. By the time he or she is 65, and even if compounded annually at 7%, they could retire comfortably, depending on inflation, of course. (Variances of returns, CPI, changing tax laws, etc., etc., apply.) Even so, that would be a nice legacy for you to leave your children. And while they’re working for you, you would be reducing your income by the wages you’re paying them.

All you have to do now is find something age-appropriate for your kids to do for your business. It’s a win-win.

Please send us more questions like these! Contact us today.