Don’t wait until the last minute! Accountants really do like to make people’s lives easier. The best way to do that is to prepare our clients so they know what’s coming. In this instance, we are talking about the five things people need to have in order to transition smoothly from not needing an audited 401(k) in the previous year to having one because your eligible employee count has changed.

Say your CPA has just called to remind you it’s time to start gathering documentation for a 401(k) audit. In the following three instances, you are faced with transitioning. This blog post will help you know what you need to have available for a smooth changeover if:

- You have never done one because you haven’t had enough employees to require it.

- You are changing auditors.

- You have a new Human Resources manager or Third-Party Administrator.

You call your recently hired Human Resources manager.

YOU: “Did you know you are responsible for handling the company’s 401(k) audit?”

HR: “Yes, but I’m not sure how to do it,” they say. “I’ve never been through one.”

YOU: “You also need to know that we’re changing auditors from the last time.“

HR: “Okay, so I don’t do the audit. I just ensure it gets done and the auditors have the right information?”

YOU: “Yes, but first, you’ll have to figure out if we need an audit. Go to this LSL CPAs blog post to see if our plan is required to have an audit this year. You will also want to talk to the third-party administrator—the TPA. The audit requirement is based on the the eligible employees at the beginning of the plan year, and a few other parameters, which are calculated by the TPA.

HR: “Okay. I’ll start on it now.”

The above conversation may take place in your company mid-year, which is great. If, on the other hand, someone realizes the audit hasn’t been done, and it’s right before the audited data is due, everyone is stressed. The TPA (who might have slipped the deadline), HR, and your CPA are all scrambling to gather documents, make calculations based on the employee census, and file the correct forms by the deadline.

Why these documents are important

Whether changing auditors or not, you’ll still need these five things.

| 401(k) Document Checklist | |

| A copy of the prior year’s IRS form 5500 | |

| The 401(k) Plan Document | |

| The Summary plan Description | |

| The Adoption Agreement | |

| The prior audited financials |

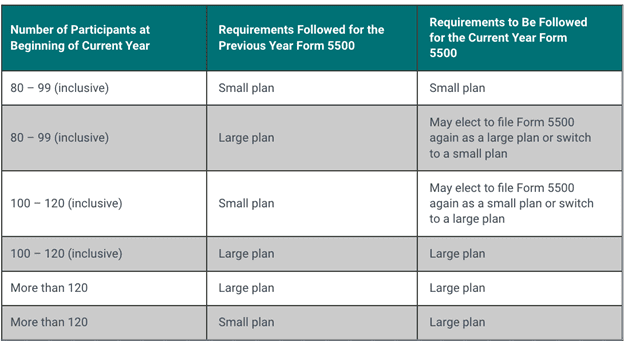

These documents are important because the auditor will understand the plan and how it’s set up. A CPA will check the employee census at the beginning and end of the year to see if the company needs an employee benefit plan audit at all and which government Form 5500 (large or small plan) needs to be filed. The chart below (from our previous blog) summarizes the participant reporting requirements, and the AICPA has details on the ERISA (Employee Retirement Income Security Act) updated sections.

One of the most important things for everyone involved is good communication on the company’s retirement plans. With that in mind, you can learn the topic’s terminology by visiting the U.S. Department of Labor website on Retirement Plans. We don’t recommend memorizing the definitions, but skimming the article will let you be somewhat conversant in retirement plan terminology and related issues that will help you be in compliance and maintain best practices throughout the plan year.

Who is responsible?

Your CPA, TPA, and HR manager (lots of abbreviations!) will all need to be involved in the audit—determining if you need one, gathering documents, doing calculations, and providing employee census information. But the CFO, CEO, and plan trustees have the fiduciary responsibility for the plan and the correctness of the data. If the company meets the requirements to have an audit, it has to be done after the fiscal or calendar year closes, depending on the plan document. The company is liable for penalties and fines if the audit is not done. And it’s not just the company by itself. The CFO, CEO, and plan trustees are personally liable. Some people don’t realize this.

What do the employees need to know?

The employees need to know there’s a retirement plan, of course, but they should also be aware that the plan is audited an annual basis. After all, it is their retirement at stake. They should also be allowed to change their paycheck withdrawals if they’re over- or under-contributing based on their home budget, cash flow, and savings goals. At LSL CPAs, we call a few of the company’s employees chosen randomly to check for their knowledge of their retirement plan. We’re not sure many CPA firms do this, but our client companies seem to like it, and so do the employees.

Conclusion

Any kind of audit can be stressful, but transitioning to a new 401(k) auditor can deliver another layer of anxiety unless you’re prepared for it. So take extra care when the HR manager is new, if the company hasn’t ever had an audit, or if it’s been a year or two since the last full audit because of employee count changes (a definite possibility since the pandemic). Everyone needs to pull together. The HR manager needs to get the correct information to the Third-Party Administrator, and both of them need to make sure the auditor has accurate data, so the Department of Labor and the IRS are happy.

If the HR manager has the staff and the capacity, we recommend they check the employee census at least twice a year. It might also help to go down the checklist to make sure you know where all five required documents are. Sometimes by the time a whole year has passed, the numbers are harder to gather, people have come and gone, and the world has changed again.

The best way to have good 401(k) audits is through frequent, clear communication on the documents and information needed with deadlines (calendar or fiscal year) defined, and everyone given enough time to make it a good audit—on time and accurately.