11/25/20

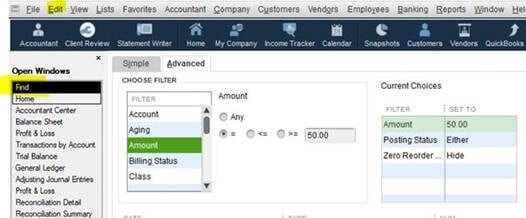

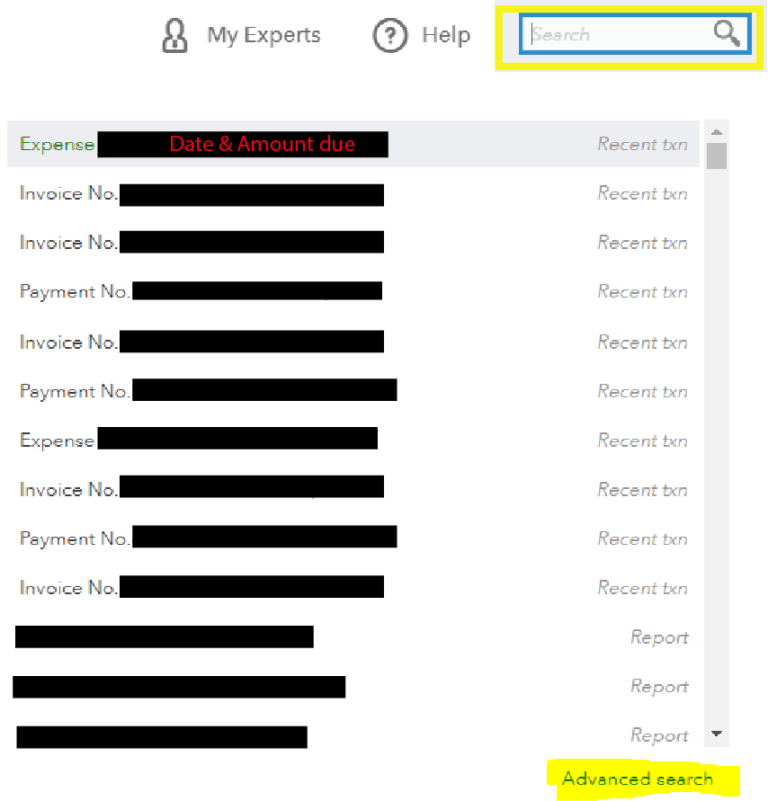

QuickBooks Online Employee Social Security Deferral Setup:

QuickBooks has updated their payroll system to allow for Employee Social Security Deferrals as outlines in the Presidential Memorandum issued August 8, 2020. As a reminder, this is an optional deferral employers can offer to their employees.

Employers will be responsible to pay back the deferred amounts by April 30, 2021, whether or not they are able to withhold the social security taxes from their employees’ paychecks from January 1, 2021 – April 30, 2021. This means that if your employee quits or is let go, it is up to you to reclaim the deferred Social Security Tax from them and remit it to the IRS.